Theory of level trading

I won’t exaggerate: every sentence below is important. Try to understand each aspect thoroughly — that’s how you’ll succeed. I’ll be as brief as possible.

How the market really works

More than 95% of the time price moves on the chart not because individual people open trades — 95% of market movement is caused by automated algorithms and big players. We humans are a drop in the ocean; we almost never move the market. It’s important to understand that a typical trader is almost always trading against algorithms, not other people — often without even realising it. Trying to beat an algorithm when you don’t know how it works is gambling, not trading.

In short: for ~95% of price movement the odds are against us.

When you can make money

We will trade only the 5% of movements on the chart.. These are the situations when most people — not just algorithms — open positions.

When people open trades, we can interpret their intentions: where they expect price to move. Our job is to learn where the majority of people place their trades, and either ride the crowd or profit from their mistakes.

Market situations where you can make money

Almost every newcomer to the market first learns about support and resistance levels. These are what most people trade worldwide and will continue to trade. We only need to understand which specific support/resistance levels the largest number of people are trading.

The answer is simple: the most visible levels for everyone. The most obvious levels. We need the crowd — the crowd means the largest concentration of stop losses, the largest volume of buys and sells. A concrete market spot where the price is most likely to move in the direction we need — where the expectation (edge) is on our side.

There are two golden rules for level selection — no joke:

- The level must be visible to everyone.

- If you have doubts about (1), then the level isn’t valid.

Levels are built (as we know) from the highest and lowest price points. Those points must be as visible as possible to all market participants.

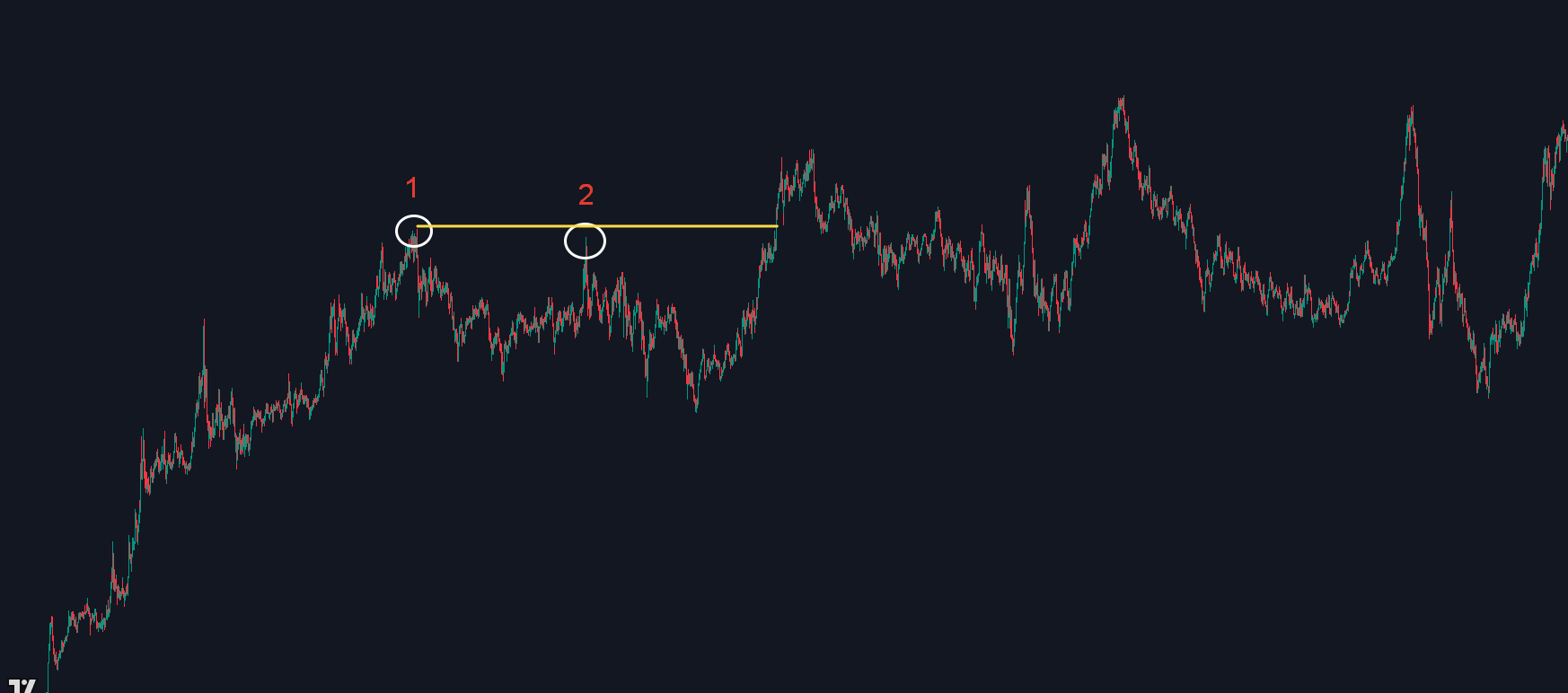

Please look at this screenshot:

I marked pronounced price peaks — anyone looking at the chart, even for the first time, will notice them.

Mostly we’re interested in levels that have at least two touches, as in the example below. When people see two touches, half of the participants will expect a breakout and will buy when price returns to the level, while the other half will open short positions and put stops beyond the level. When price crosses the level, stops trigger and add fuel to the movement.

So the odds can be on our side: one half buys at the level, while stops from the short positions (which are buys) trigger — and price rockets up.

How to increase edge and the odds of a profitable trade

- Two touches should ideally be as close to each other in price as possible. The difference in price between touches should not be large. This is asset-dependent: some traders place stops behind the first touch, some behind the second. If the breakout starts, there may be too few stops/buys to push the price to the first touch and instead the price may fall. Example image:

- A slow approach of price to the level and a slowdown before it. When price stalls near the level before a breakout, some participants who expect a bounce start to open short positions — their stops will add fuel when triggered. Also look for price compressing into the level (triangle compression) — that’s a good sign. Example image:

In practice, these two items alone are often enough to trade profitably.

The more obvious and “clean” a level looks — the more people see it — the higher the chance price will behave as we expect.

Why a level sometimes fails to break

Common reasons:

- The traded asset has few participants — there are few stops beyond the level, so few buys after the break.

- There is a cluster of large limit orders behind the level that absorb the stops/buys and stop the move.

- Price briefly pokes above the level (someone makes a large buy), then returns: traders interpret it as a false breakout and start selling en masse, with selling algorithms joining in. The combined effect pushes price down.

- The asset lacks liquidity (visible in the volume indicator), so both stops and breakout buys are tiny.

Trade only assets that are "in play"

In the past there were relatively few cryptocurrencies, many traders, and many stop losses concentrated in a handful of coins — breakouts tended to work very predictably. Now there are hundreds or thousands of cryptos and everyone trades everything. Roughly: if before 1000 people traded 3 cryptos, now 1000 people trade 1000 cryptos. There’s no single crowd. Liquidity is spread across hundreds of coins, not just the top 10.

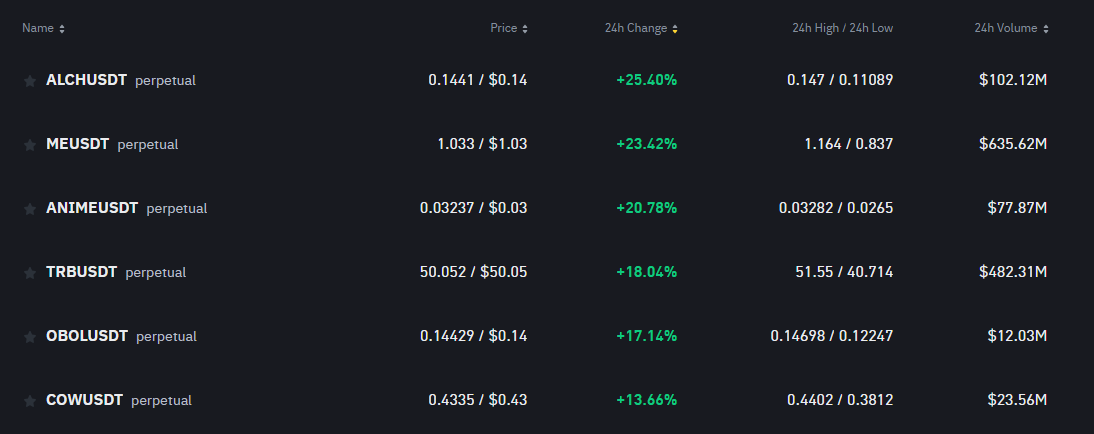

The solution is simple. Open your crypto exchange and sort coins by “24h Change” — the ones that moved most in the last 24 hours are what we need. Those are the coins everyone is looking at and putting money (and stops) into.

Choose coins that either rose the most or fell the most in the day. Prefer coins with daily volume of at least $100–200 million — they’ll have crowd activity and money.

You can also sort by 24h volume to spot new coins that suddenly attract large liquidity flows (ignore the always-top popular coins). Those new high-volume coins will often also be in the top movers.

For classic markets (stocks, forex) the same rule applies: only trade assets where the crowd has come in with money. Focus on the assets that have moved the most right now.

This is what I call assets “in play.” This is the most important secret of profitable trading: successful traders trade only assets that are in play. Remember that.

Checklist before entry

- The instrument is “In Play” — it moved more than others and has sufficient daily volume (for cryptos, from ~$100,000), meaning there will be people and stops.

- The level is visible to everyone — two highest/lowest points that even a cat seeing a chart for the first time would notice; the two points are close in price.

- Price slowly compresses toward the level — ideally forming a triangle.

- If there’s the slightest doubt, do not trade. Never. Even if in retrospect you would have won.

- Use a fixed dollar stop loss amount for all trades. No exceptions. Your stop could be 10% or 0.10%, but the monetary loss must always be the same. To achieve this, always calculate position size per trade.

Following these rules consistently will allow you — with experience — to profit even in less than ideal setups. But that comes only with a lot of experience.